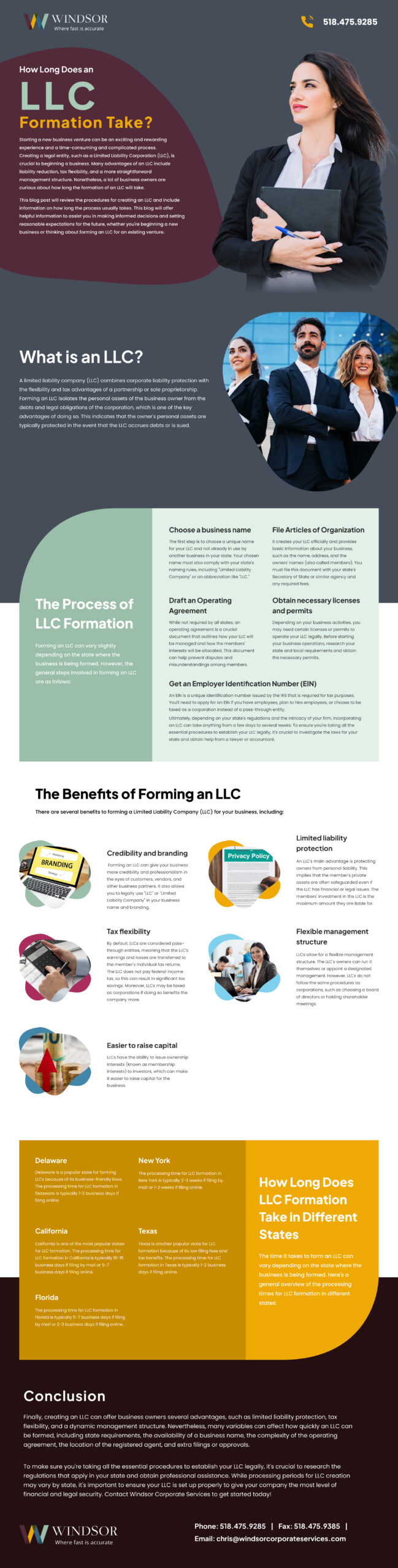

How Long Does an LLC Formation Take?[Infographic]

Starting a new business venture can be an exciting and rewarding experience and a time-consuming and complicated process. Creating a legal entity, such as a Limited Liability Corporation (LLC), is crucial to beginning a business. Many advantages of an LLC include liability reduction, tax flexibility, and a more straightforward management structure. Nonetheless, a lot of business owners are curious about how long the formation of an LLC will take.

This blog post will review the procedures for creating an LLC and include information on how long the process usually takes. This blog will offer helpful information to assist you in making informed decisions and setting reasonable expectations for the future, whether you’re beginning a new business or thinking about forming an LLC for an existing venture.

What is an LLC?

A limited liability company (LLC) combines corporate liability protection with the flexibility and tax advantages of a partnership or sole proprietorship. Forming an LLC isolates the personal assets of the business owner from the debts and legal obligations of the corporation, which is one of the key advantages of doing so. This indicates that the owner’s personal assets are typically protected in the event that the LLC accrues debts or is sued.

The Process of LLC Formation

Forming an LLC can vary slightly depending on the state where the business is being formed. However, the general steps involved in forming an LLC are as follows:

- Choose a business name: The first step is to choose a unique name for your LLC and not already in use by another business in your state. Your chosen name must also comply with your state’s naming rules, including “Limited Liability Company” or an abbreviation like “LLC.”

- File Articles of Organization: It creates your LLC officially and provides basic information about your business, such as the name, address, and the owners’ names (also called members). You must file this document with your state’s Secretary of State or similar agency and any required fees.

- Draft an Operating Agreement: While not required by all states, an operating agreement is a crucial document that outlines how your LLC will be managed and how the members’ interests will be allocated. This document can help prevent disputes and misunderstandings among members.

- Obtain necessary licenses and permits: Depending on your business activities, you may need certain licenses or permits to operate your LLC legally. Before starting your business operations, research your state and local requirements and obtain the necessary permits.

- Get an Employer Identification Number (EIN): An EIN is a unique identification number issued by the IRS that is required for tax purposes. You’ll need to apply for an EIN if you have employees, plan to hire employees, or choose to be taxed as a corporation instead of a pass-through entity.

Ultimately, depending on your state’s regulations and the intricacy of your firm, incorporating an LLC can take anything from a few days to several weeks. To ensure you’re taking all the essential procedures to establish your LLC legally, it’s crucial to investigate the laws for your state and obtain help from a lawyer or accountant.

The Benefits of Forming an LLC

There are several benefits to forming a Limited Liability Company (LLC) for your business, including:

- Credibility and branding: Forming an LLC can give your business more credibility and professionalism in the eyes of customers, vendors, and other business partners. It also allows you to legally use “LLC” or “Limited Liability Company” in your business name and branding.

- Limited liability protection: An LLC’s main advantage is protecting owners from personal liability. This implies that the member’s private assets are often safeguarded even if the LLC has financial or legal issues. The members’ investment in the LLC is the maximum amount they are liable for.

- Tax flexibility: By default, LLCs are considered pass-through entities, meaning that the LLC’s earnings and losses are transferred to the member’s individual tax returns. The LLC does not pay federal income tax, so this can result in significant tax savings. Moreover, LLCs may be taxed as corporations if doing so benefits the company more.

- Flexible management structure: LLCs allow for a flexible management structure. The LLC’s owners can run it themselves or appoint a designated management. However, LLCs do not follow the same procedures as corporations, such as choosing a board of directors or holding shareholder meetings.

- Easier to raise capital: LLCs have the ability to issue ownership interests (known as membership interests) to investors, which can make it easier to raise capital for the business.

How Long Does LLC Formation Take in Different States

The time it takes to form an LLC can vary depending on the state where the business is being formed. Here’s a general overview of the processing times for LLC formation in different states:

- Delaware: Delaware is a popular state for forming LLCs because of its business-friendly laws. The processing time for LLC formation in Delaware is typically 1-2 business days if filing online.

- California: California is one of the most popular states for LLC formation. The processing time for LLC formation in California is typically 10-15 business days if filing by mail or 5-7 business days if filing online.

- New York: The processing time for LLC formation in New York is typically 2-3 weeks if filing by mail or 1-2 weeks if filing online.

- Texas: Texas is another popular state for LLC formation because of its low filing fees and tax benefits. The processing time for LLC formation in Texas is typically 1-2 business days if filing online.

- Florida: The processing time for LLC formation in Florida is typically 5-7 business days if filing by mail or 2-3 business days if filing online.

Conclusion

Finally, creating an LLC can offer business owners several advantages, such as limited liability protection, tax flexibility, and a dynamic management structure. Nevertheless, many variables can affect how quickly an LLC can be formed, including state requirements, the availability of a business name, the complexity of the operating agreement, the location of the registered agent, and extra filings or approvals.

To make sure you’re taking all the essential procedures to establish your LLC legally, it’s crucial to research the regulations that apply in your state and obtain professional assistance. While processing periods for LLC creation may vary by state, it’s important to ensure your LLC is set up properly to give your company the most level of financial and legal security. Contact Windsor Corporate Services to get started today!