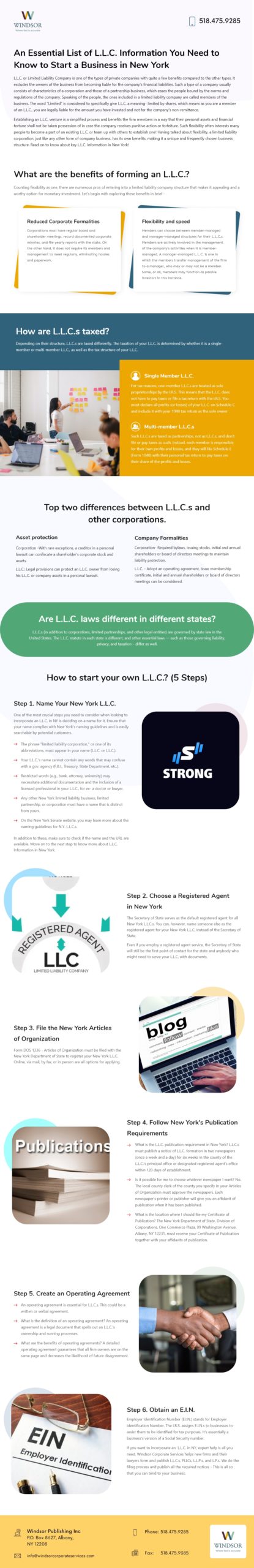

An Essential List of L.L.C. Information You Need to Know to Start a Business in New York [Infographic]

L.L.C. or Limited Liability Company is one of the types of private companies with quite a few benefits compared to the other types. It excludes the owners of the business from becoming liable for the company’s financial liabilities. Such a type of a company usually consists of characteristics of a corporation and those of a partnership business, which eases the people bound by the norms and regulations of the company. Speaking of the people, the ones included in a limited liability company are called members of the business. The word “Limited” is considered to specifically give L.L.C. a meaning- limited by shares, which means as you are a member of an L.L.C., you are legally liable for the amount you have invested and not for the company’s non-remittance. Establishing an L.L.C. venture is a simplified process and benefits the firm members in a way that their personal assets and financial fortune shall not be taken possession of in case the company receives punitive action or forfeiture. Such flexibility often interests many people to become a part of an existing L.L.C. or team up with others to establish one! Having talked about flexibility, a limited liability corporation, just like any other form of company business, has its own benefits, making it a unique and frequently chosen business structure. Read on to know about key L.L.C. Information in New York!

What are the benefits of forming an L.L.C.?

Counting flexibility as one, there are numerous pros of entering into a limited liability company structure that makes it appealing and a worthy option for monetary investment. Let’s begin with exploring these benefits in brief – Reduced Corporate Formalities Corporations must have regular board and shareholder meetings, record documented corporate minutes, and file yearly reports with the state. On the other hand, it does not require its members and management to meet regularly, eliminating hassles and paperwork. Flexibility and speed Members can choose between member-managed and manager-managed structures for their L.L.C.s. Members are actively involved in the management of the company’s activities when it is member-managed. A manager-managed L.L.C. is one in which the members transfer management of the firm to a manager, who may or may not be a member. Some, or all, members may function as passive investors in this instance.

How are L.L.C.s taxed?

Depending on their structure, L.L.C.s are taxed differently. The taxation of your L.L.C. is determined by whether it is a single-member or multi-member L.L.C., as well as the tax structure of your L.L.C. Single Member L.L.C. For tax reasons, one-member L.L.C.s are treated as sole proprietorships by the I.R.S. This means that the L.L.C. does not have to pay taxes or file a tax return with the I.R.S. You must declare all profits (or losses) of your L.L.C. on Schedule C and include it with your 1040 tax return as the sole owner. Multi-member L.L.C.s Such L.L.C.s are taxed as partnerships, not as L.L.C.s, and don’t file or pay taxes as such. Instead, each member is responsible for their own profits and losses, and they will file Schedule E (Form 1040) with their personal tax return to pay taxes on their share of the profits and losses.

Top two differences between L.L.C.s and other corporations

-

Asset protection

Corporation -With rare exceptions, a creditor in a personal lawsuit can confiscate a shareholder’s corporate stock and assets. L.L.C.: Legal provisions can protect an L.L.C. owner from losing his L.L.C. or company assets in a personal lawsuit.

-

Company Formalities

Corporation– Required bylaws, issuing stocks, initial and annual shareholders or board of directors meetings to maintain liability protection. L.L.C. – Adopt an operating agreement, issue membership certificate, initial and annual shareholders or board of directors meetings can be considered.

Are L.L.C. laws different in different states?

L.L.C.s (in addition to corporations, limited partnerships, and other legal entities) are governed by state law in the United States. The L.L.C. statute in each state is different, and other essential laws — such as those governing liability, privacy, and taxation – differ as well.

How to start your own L.L.C.? (5 Steps)

Step 1. Name Your New York L.L.C.

One of the most crucial steps you need to consider when looking to incorporate an L.L.C. in NY is deciding on a name for it. Ensure that your name complies with New York’s naming guidelines and is easily searchable by potential customers.

- The phrase “limited liability corporation,” or one of its abbreviations, must appear in your name (L.L.C. or L.L.C.).

- Your L.L.C.’s name cannot contain any words that may confuse with a gov. agency (F.B.I., Treasury, State Department, etc.).

- Restricted words (e.g., bank, attorney, university) may necessitate additional documentation and the inclusion of a licensed professional in your L.L.C., for ex- a doctor or lawyer.

- Any other New York limited liability business, limited partnership, or corporation must have a name that is distinct from yours.

- On the New York Senate website, you may learn more about the naming guidelines for N.Y. L.L.C.s.

In addition to these, make sure to check if the name and the URL are available. Move on to the next step to know more about L.L.C. Information in New York.

Step 2. Choose a Registered Agent in New York

The Secretary of State serves as the default registered agent for all New York L.L.C.s. You can, however, name someone else as the registered agent for your New York L.L.C. instead of the Secretary of State. Even if you employ a registered agent service, the Secretary of State will still be the first point of contact for the state and anybody who might need to serve your L.L.C. with documents.

Step 3. File the New York Articles of Organization

Form DOS 1336 – Articles of Organization must be filed with the New York Department of State to register your New York L.L.C. Online, via mail, by fax, or in person are all options for applying.

Step 4. Follow New York’s Publication Requirements

- What is the L.L.C. publication requirement in New York? L.L.C.s must publish a notice of L.L.C. formation in two newspapers (once a week and a day) for six weeks in the county of the L.L.C.’s principal office or designated registered agent’s office within 120 days of establishment.

- Is it possible for me to choose whatever newspaper I want? No. The local county clerk of the county you specify in your Articles of Organization must approve the newspapers. Each newspaper’s printer or publisher will give you an affidavit of publication when it has been published.

- What is the location where I should file my Certificate of Publication? The New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231, must receive your Certificate of Publication together with your affidavits of publication.

Step 5. Create an Operating Agreement

- An operating agreement is essential for L.L.C.s. This could be a written or verbal agreement.

- What is the definition of an operating agreement? An operating agreement is a legal document that spells out an L.L.C.’s ownership and running processes.

- What are the benefits of operating agreements? A detailed operating agreement guarantees that all firm owners are on the same page and decreases the likelihood of future disagreement.

Step 6. Obtain an E.I.N.

Employer Identification Number (E.I.N.) stands for Employer Identification Number. The I.R.S. assigns E.I.N.s to businesses to assist them to be identified for tax purposes. It’s essentially a business’s version of a Social Security number. If you want to incorporate an L.L.C. in NY, expert help is all you need. Windsor Corporate Services helps new firms and their lawyers form and publish L.L.C.s, PLLCs, L.L.P.s, and L.P.s. We do the filing process and publish all the required notices – This is all so that you can tend to your business.